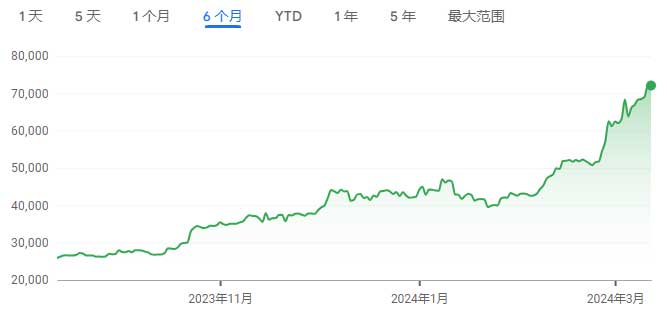

Bitcoin miners earn new coins by verifying and adding transactions to the blockchain network, while also profiting from fees paid by users. With the price of the largest cryptocurrency, Bitcoin, continuing to trade at record levels, Bitcoin miners’ revenues reached an all-time high last week.

On March 7, daily revenue for Bitcoin miners reached $78.6 million, surpassing the peak set in April 2021 during the last cryptocurrency bull market.

It is understood that after a prolonged downturn caused by a series of cryptocurrency scandals and bankruptcies in 2022, the price of Bitcoin began to rebound last year, and the U.S. spot Bitcoin exchange-traded fund (ETF), which made its debut on Jan. 11, received a net inflow of about $9.5 billion, which further pushed up the price.

In addition, Bitcoin’s upcoming halving event in April, when miners’ incentives will be halved and the growth in the coin’s supply will slow, has encouraged bets on higher prices.

On Monday, the token’s price was near an all-time high of $72,881, as miners’ incomes surged against the backdrop of a 70 percent increase in the price of bitcoin so far this year.

For miners, it’s the backdrop for a remarkable rebound from the doldrums of the cryptocurrency winter. For example, the Valkyrie Bitcoin Miners ETF, which includes companies like CleanSpark (CLSK.US) and Marathon Digital (MARA.US), has more than doubled in the last 12 months.

At the moment, companies are scrambling to set themselves up for success. It was reported earlier that since February 2023, 13 top mining companies have placed orders for more than $1 billion worth of specialized computers.

Bitcoin Price About to Top $100,000

Advertisements

Your article helped me a lot, is there any more related content? Thanks!